Apple is a colossus. Some of us might remember back when it was doomed and nearly bankrupt, but these days, it generates hundreds of billions of dollars in revenue every day and has a market capitalization of more than three trillion dollars.

And yet even the most powerful companies are fallible. Often they have a hubris that suggests that their success in one area means they can easily extend it to others–often with disastrous results.

This week, Apple got another reminder that even its mighty power might not be able to make it succeed at all its ambitions. Don’t be embarrassed, Apple. Even the world’s most beautiful models still get pimples from time to time.

Money isn’t banking

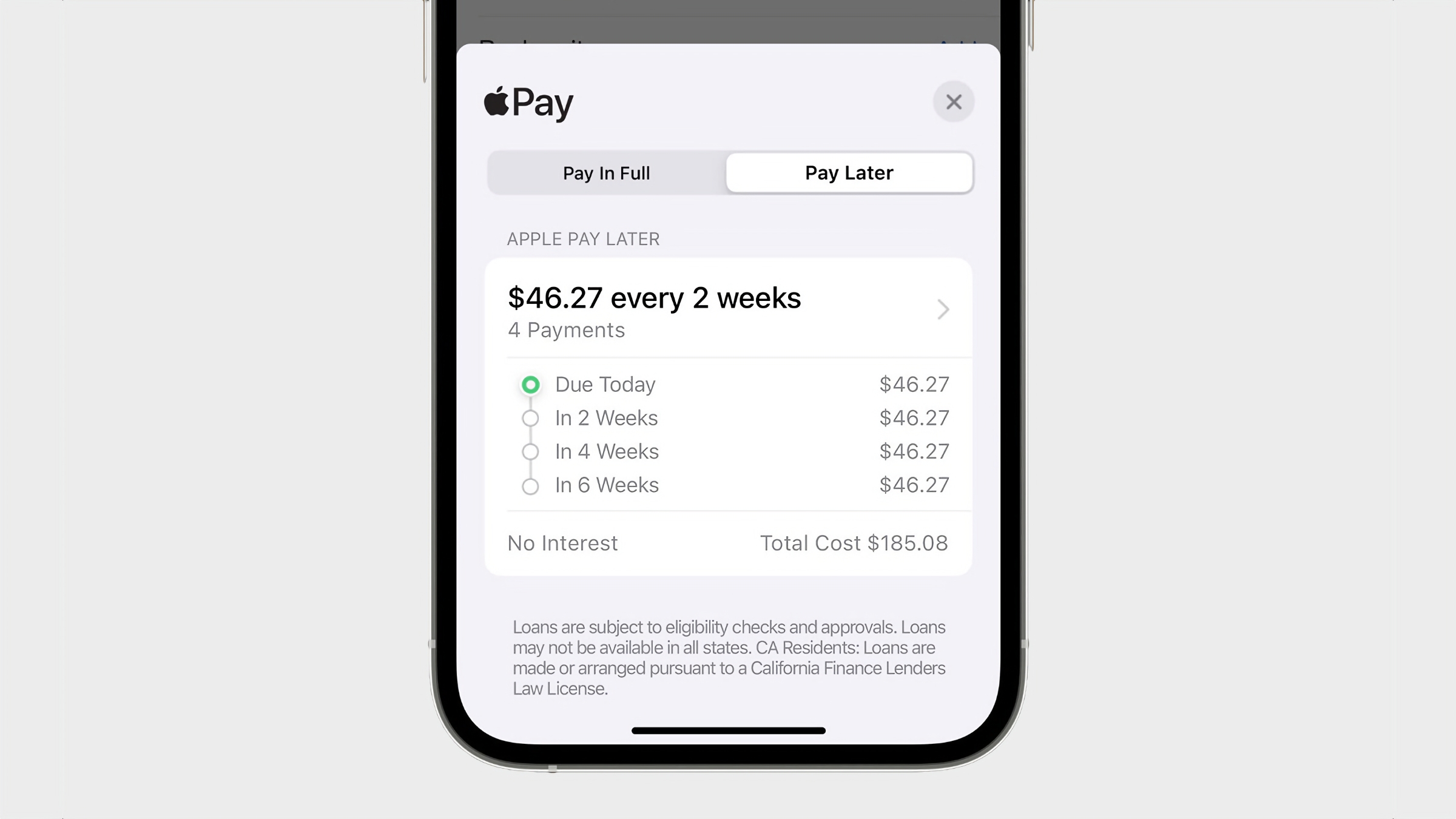

Apple is giving up on Apple Pay Later, a split-payment service that it announced two years ago and launched in the spring of 2023. It was a loan service backed by an Apple-owned financial entity, Apple Financing LLC.

Yet it turns out that despite Apple’s ambitions, which were so great that the company basically set up its own bank, the whole thing was a flop. Apple says it will recalibrate this fall with buy-now-pay-later schemes using partners.

These events shouldn’t really be surprising, though. Despite its overall success with Apple Pay, Apple has shown that it gets bogged down when it wades into deeper financial waters.

Apple Card was an attempt to innovate credit cards, with unique features and Apple Wallet integration. But for years now, stories have abounded that Goldman Sachs is trying to get out of its deal and that Apple is amenable to the breakup. Apple Card is also coming up on its fifth anniversary and has still never extended beyond the United States.

Speaking of international rollouts, Apple Cash–an easy digital cash transfer system that was presumably built to rival Venmo and Zelle–is also only available in the U.S., where it feels more like a weird vestige of the Apple Card than a bigger, more useful feature. I do send people money with Apple Cash, but every time I want to do so with my friends in the U.K., I’m reminded that they just don’t have it.

Apple Pay Later will be replaced by third-party payment plans.

Apple

A few years ago, Apple seemed to have some serious financial ambitions and the desire to do more of it inside the company itself. Now it’s shuttering its loan service, its Apple Card partner is bailing, and many services remain locked to a single market.

Apple seems to have discovered that having all the money is not the same thing as being a bank.

Auto ambitions

Consider the auto industry. Once ripe for disruption, these days, most of the automakers are fully invested in electric vehicles and computer console dashboards with automated driving features. That probably explains why Apple’s own car project, which cost billions and spanned a decade, was finally killed this year. There was a time when Apple might have brought something dramatic and disruptive to cars, but it feels like time has passed.

But it’s not just Apple’s consideration of making its own car that shows that Apple’s had a tough time of it in the auto space. Yes, the iPhone’s popularity has led to broad adoption of CarPlay–because despite the auto industry’s best efforts, people will always be more loyal to their smartphone than their car’s own software–but Apple has tried and failed to make more of that advantage.

Two years ago, Apple announced a “next-generation CarPlay” experience that involved CarPlay taking over the entire dash of compatible cars. It said it was working with some high-end partners, but basically, nothing has come of that announcement. This year’s WWDC features some new sessions about CarPlay, but it seems that Apple is more interested in “educating” carmakers about why Apple is right, actually, than in listening to carmakers and understanding why they are resistant to Apple’s attempts to override their own interfaces.

Prediction: It’s gonna be a bumpy ride, and Apple might want to start focusing on offering its ecosystem apps to CarPlay-resistant carmakers. (It recently launched Apple Music and Podcasts support in the non-CarPlay Tesla interface, for instance.)

[embedded content]

Big as a government, maybe

And then there’s regulation. Apple’s had a very aggressive approach to government and regulation. Bold move–let’s see how it works out for them.

So far, the answer is… not great? Apple had to spend a lot of last year’s iOS cycle building new features just for the European Union, and will undoubtedly spend some of this year’s cycle addressing all the ways that last year’s “fixes” didn’t actually meet the terms of the Digital Markets Act.

Meanwhile, here comes Japan, passing its own take on the DMA that will probably open up competition to the App Store in that country at the end of next year.

Could all of this have been avoided? Perhaps, but Apple’s approach has almost welcomed the fight–and it is finding out that if the regulators of a valuable market don’t like the game you’re playing, you’ll need to spend a lot of time and money to please them.

Maybe a more political stance would’ve helped. But maybe that’s just not Apple’s way.

Sometimes it works

Look, I’m not saying that Apple should stick to its knitting. Sometimes it can be spectacularly successful for Apple to go beyond its comfort zone and try new things–witness the iPod and iPhone!

I’m also not saying we should point and laugh at Apple’s failures. But I do think it’s instructive to observe the places where the company steps on a rake, because it says something about its blind spots. To understand Apple is to understand what it’s good at–and what it’s not.

Source : Macworld