For a while in the mid-2000s, a refrigerator-sized box in Abu Dhabi was considered the greatest chess player in the world. Its name was Hydra, and it was a small super-computer—a cabinet full of industrial-grade processors and specially designed chips, strung together with fiber-optic cables and jacked into the internet.

At a time when chess was still the main gladiatorial arena for competition between humans and AI, Hydra and its exploits were briefly the stuff of legend. The New Yorker published a contemplative 5,000-word feature about its emergent creativity; WIRED declared Hydra “fearsome”; and chess publications covered its victories with the violence of wrestling commentary. Hydra, they wrote, was a “monster machine” that “slowly strangled” human grand masters.

True to form as a monster, Hydra was also isolated and strange. Other advanced chess engines at the time—Hydra’s rivals—ran on ordinary PCs and were available for anyone to download. But the full power of Hydra’s 32-processor cluster could be used by only one person at a time. And by the summer of 2005, even the members of Hydra’s development team were struggling to get a turn with their creation.

That’s because the team’s patron—the then 36-year-old Emirati man who’d hired them and put up the money for Hydra’s souped-up hardware—was too busy reaping his reward. On an online chess forum in 2005, Hydra’s Austrian chief architect, Chrilly Donninger, described this benefactor as the greatest “computer chess freak” alive. “The sponsor,” he wrote, “loves to play day and night with Hydra.”

Under the username zor_champ, the Emirati sponsor would log in to online chess tournaments and, with Hydra, play as a human-computer team. More often than not, they would trounce the competition. “He loved the power of man plus machine,” one engineer told me. “He loved to win.”

Hydra eventually got overtaken by other chess computers and was discontinued in the late 2000s. But zor_champ went on to become one of the most powerful, least understood men in the world. His real name is Sheikh Tahnoun bin Zayed al Nahyan.

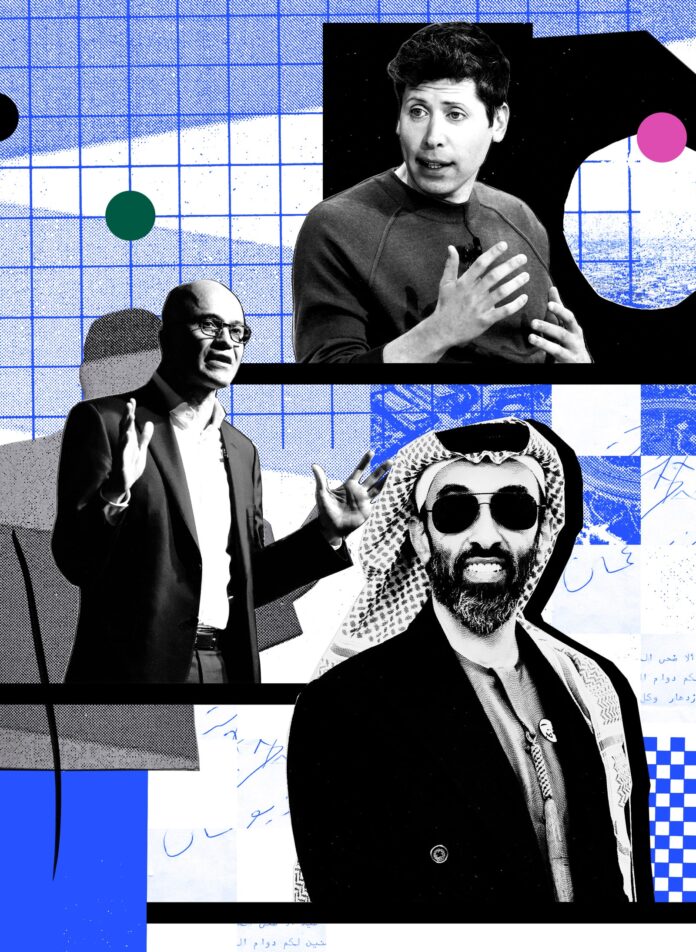

A bearded, wiry figure who’s almost never seen without dark sunglasses, Tahnoun is the United Arab Emirates’ national security adviser—the intelligence chief to one of the world’s wealthiest and most surveillance-happy small nations. He’s also the younger brother of the country’s hereditary, autocratic president, Mohamed bin Zayed al Nahyan. But perhaps most important, and most bizarrely for a spymaster, Tahnoun wields official control over much of Abu Dhabi’s vast sovereign wealth. Bloomberg News reported last year that he directly oversees a $1.5 trillion empire—more cash than just about anyone on the planet.

In his personal style, Tahnoun comes across as one-third Gulf royal, one-third fitness-obsessed tech founder, and one-third Bond villain. Among his many, many business interests, he presides over a sprawling tech conglomerate called G42 (a reference to the book The Hitchhiker’s Guide to the Galaxy, in which “42” is a super-computer’s answer to the question of “life, the universe, and everything”). G42 has a hand in everything from AI research to biotechnology—with special areas of strength in state-sponsored hacking and surveillance tech. Tahnoun is fanatical about Brazilian jiujitsu and cycling. He wears his sunglasses even at the gym because of a sensitivity to light, and he surrounds himself with UFC champions and mixed martial arts fighters.

According to a businessman and a security consultant who’ve met with Tahnoun, visitors who make it past his layers of loyal gatekeepers might get a chance to speak with him only after cycling laps with the sheikh around his private velodrome. He has been known to spend hours in a flotation chamber, the consultant says, and has flown health guru Peter Attia into the UAE to offer guidance on longevity. According to a businessman who was present for the discussion, Tahnoun even inspired Mohammed bin Salman, Saudi Arabia’s powerful crown prince, to cut back on fast food and join him in a quest to live to 150.

But in recent years, a new quest has taken up much of Sheikh Tahnoun’s attention. His onetime chess and technology obsession has morphed into something far bigger: a hundred-billion-dollar campaign to turn Abu Dhabi into an AI superpower. And the teammate he’s set out to buy this time is the United States tech industry itself.

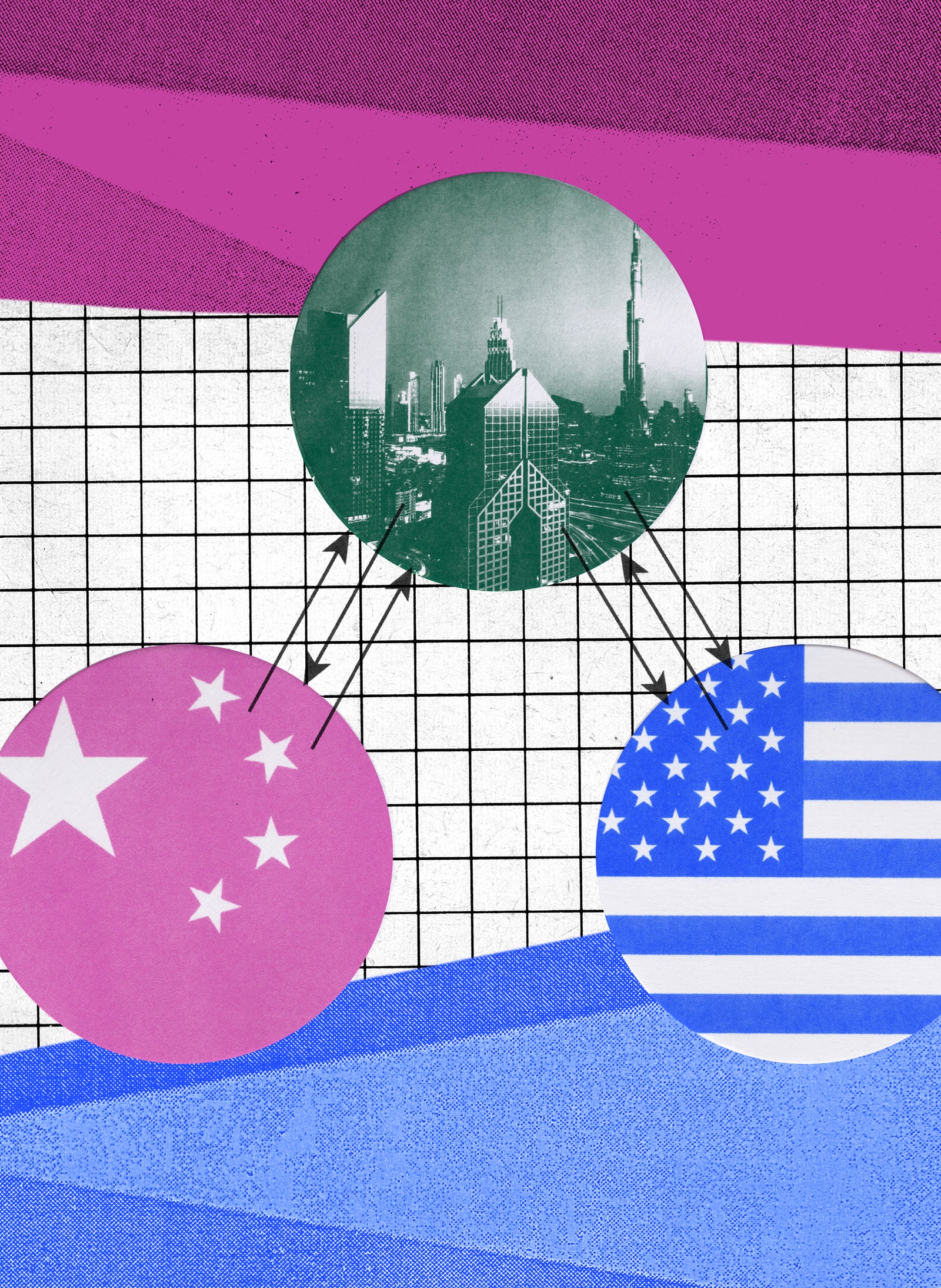

In the multiplayer game of strategy that is the AI arms race, the US controls the board right now for a pretty simple reason. A single American hardware company, Nvidia, makes the chips that train the most competitive AI models—and the US government has moved to restrict who can buy these Nvidia GPUs (as the chips are called) outside the country’s borders. To take advantage of this clear but jittery lead over China, the CEOs of America’s AI giants have fanned out across the globe to sweet-talk the world’s richest investors—people like Tahnoun—into financing what amounts to an enormous building boom.

Lurking behind every synthetic podcast and serving of AI slop is a huge, thrumming data center: Hundreds of Hydra-sized server cabinets lined up in tight rows, running computing processes that are tens or hundreds of times more energy-intensive than ordinary web searches. And behind those is another set of data centers that train foundational AI models. To keep pace with demand, AI companies need more data centers all over the world—plus the land to put them on, the water to cool them, the electricity to power them, and the microchips to run them. Nvidia CEO Jensen Huang has predicted that tech companies will pour a trillion dollars into new AI data centers over the next five years.

Building out the next phase of AI, in short, is set to require mind-boggling amounts of capital, real estate, and electricity—and the Gulf States, with their vast oil wealth and energy resources, possess all three. Saudi Arabia, Kuwait, and Qatar have all set up major AI investment funds in the past couple of years. But as a home for new data centers and a source of investment capital, the UAE has emerged as a particularly attractive potential partner on a number of fronts—from its sheer wealth to its brand-new nuclear power supply to the relative sophistication of its own AI sector.

But there’s a rub: Any American AI partnership with the UAE is, in some way, a relationship with Sheikh Tahnoun himself—and for years many of Tahnoun’s most important technology partners have been Chinese.

The pairing was only natural, given Tahnoun’s record as a spy chief with vast commercial interests in high-tech state control. Tahnoun spent the early 2020s forging deep business and personal ties with Beijing, to the point that some products sold by G42 came to be nearly indistinguishable from Chinese ones. A G42 subsidiary called Presight AI, for one, sold surveillance software to police forces worldwide that bore a close resemblance to systems used by Chinese law enforcement. The Chinese telecom giant Huawei’s footprints in G42 went even deeper. Early in the

generative-AI boom, Huawei’s engineers moved freely through Abu Dhabi’s most sensitive tech facilities as they designed massive AI training centers.

But in August of 2023, Washington threw down a gauntlet. It restricted exports of Nvidia GPUs to the Middle East—the very hardware that Abu Dhabi needed to realize its own AI ambitions. No company using Huawei equipment would get access. So Tahnoun pivoted, hard. In early 2024, G42 announced it was severing ties with China and would rip out Chinese equipment. Chinese nationals began quietly departing Abu Dhabi’s tech sector.

At the same time, US and UAE leaders went into a fevered phase of mutual courtship. Scores of public relations consultants, lawyers, and Beltway lobbyists set about portraying Tahnoun as a safe pair of hands in which to place US technology and trust. Marty Edelman, the emirate’s most trusted American lawyer, helped orchestrate the strategy from New York. The UAE’s ambassador to Washington, Yousef Al Otaiba, deployed his considerable political capital to vouch for Tahnoun. Meanwhile, US government and tech leaders tried to maneuver what promised to be a huge spigot of Emirati money into the United States, to feed AI companies’ need for investment.

The first sign that the two sides had reached an understanding was, bizarrely, a deal that flowed in the opposite direction. In an unusual agreement brokered largely by officials in the Biden administration, Microsoft announced in April 2024 that it was investing $1.5 billion in Tahnoun’s G42, acquiring a minority stake in the company. According to remarks by a Biden official who helped steer the agreement, the objective was to get G42 to “work with Microsoft as an alternative to Huawei.” In the first phase of the relationship, G42 would gain access to Microsoft’s AI computing power on its Azure cloud platform, at a data center inside the UAE. And Brad Smith, Microsoft’s president, would join the board of G42—a kind of American chaperone inside the company.

The big gushers of cash from the UAE were still to come, as were any Nvidia chips for Abu Dhabi. But the Microsoft deal amounted to a US government seal of approval for further business with the Emirates. In the summer of 2024, Tahnoun embarked on a charm offensive across the United States, with a visit to Elon Musk in Texas and a jiujitsu session with Mark Zuckerberg. Meetups with Bill Gates, Satya Nadella, and Jeff Bezos followed in quick succession. The most important meetings, however, took place at the White House, with figures like national security adviser Jake Sullivan, Commerce secretary Gina Raimondo, and President Joe Biden himself.

As the frenzied campaign to reframe Tahnoun and G42’s image seemed to gain traction—and the US seemed poised to loosen export controls on advanced chips for the UAE—some inside the US national security establishment were, just as frantically, waving caution flags. One of their fears is that the intellectual property of the United States could still leak to China. “The Emiratis are the consummate hedgers,” a former senior US security official told me. “The question everyone has: Are they playing both sides?” In a July open letter, US congressman Michael McCaul, the chair of the House Foreign Affairs Committee, called for “significantly more robust national security guardrails” to be placed on the UAE before the US exported any sensitive technology to the country.

But the other fear is of the UAE itself—a country whose vision of using AI as a mechanism of state control is not all that different from Beijing’s. “The UAE is an authoritarian state with a dismal human rights record and a history of using technology to spy on activists, journalists, and dissidents,” says Eva Galperin, director of cybersecurity at the Electronic Frontier Foundation. “I don’t think there is any doubt that the UAE would like to influence the course of AI development”—in ways that are optimized not for democracy or any “shared human values,” but for police states.

This past summer, around the same time that Tahnoun was barnstorming through America’s dojos and C-suites, Mohammed bin Salman, the crown prince of Saudi Arabia, was hosting some of the world’s leading technology thinkers—including former Google CEO Eric Schmidt—at his vast South African hunting estate called Ekland. They visited game parks, were waited on by butlers, and discussed Saudi Arabia’s future role in AI.

Not long after, Schmidt made a trip to the Biden White House to air his concerns that the US cannot produce enough electricity to compete in AI. His suggestion? Closer financial and business ties with hydroelectric-rich Canada. “The alternative is to have the Arabs fund [AI],” he told a group of Stanford students on video the following week. “I like the Arabs personally … But they’re not going to adhere to our national security rules.”

Those concerns over the Gulf States’ reliability as allies (and their tendencies to engage in unsavory practices like targeting journalists and waging proxy wars) haven’t stopped their money from flowing into US tech companies. Earlier in the year, Saudi Arabia’s sovereign Public Investment Fund announced a $40 billion fund focused on AI investments, aided by a strategic partnership with the Silicon Valley venture capital firm Andreessen Horowitz. Kingdom Holding, an investment firm run by a Saudi royal who is deeply obedient to the crown prince, has also emerged as one of the biggest investors in Elon Musk’s startup xAI.

The New York Times wrote that the new Saudi fund made that country “the world’s largest investor in artificial intelligence.” But in September, the UAE eclipsed it: Abu Dhabi announced that a new AI investment vehicle called MGX would partner with BlackRock, Micro-soft, and Global Infrastructure Partners to pour more than $100 billion into, among other things, building a network of data centers and power plants across the United States. MGX—which is part of Tahnoun’s sovereign wealth portfolio—has also reportedly been in “early talks” with OpenAI CEO Sam Altman about what Altman hopes will be a 5 to 7 trillion-dollar moonshot chipmaking venture to create an alternative to Nvidia’s scarce GPUs.

The spigot of Emirati cash was now open. And in turn, within days of the MGX announcement, the news site Semafor reported that the US had cleared Nvidia to sell GPUs to G42. Some of the chips were already being deployed in Abu Dhabi, the news site reported, including “a sizable order of Nvidia H100 models.” The US had finally given Tahnoun some of the hardware he needed to build his next Hydra. Which raises the salience of two questions: What kind of game is Sheikh Tahnoun playing this time? And how exactly did he get control of so much wealth?

on some level, nearly every story about royalty in the Gulf is a story about succession—about paternalistic families trying to ward off external threats, and the internal rivalries that crop up when inherited power is up for grabs.

Tahnoun and his brother Mohamed are both sons of the UAE’s first president, Zayed bin Sultan al Nahyan—an iconic figure revered as the father of the nation.

For much of Zayed’s life, what is now the city of Abu Dhabi was an austere, seasonal fishing village with a harsh climate, a brackish water supply, and a nomadic population of about 2,000 people. The rest of the emirate had several thousand more Bedouin inhabitants. As rulers, the al Nahyans were paid in tributes and taxes, and served as custodians of the emirate’s shared resources. Their lifestyle wasn’t all that much better than that of their fellow tribesmen. But still it was dangerous at the top. Before Zayed, two of the last four sheikhs of Abu Dhabi had been assassinated by their brothers; another had been killed by a rival tribe.

Zayed, for his part, seized power from his older brother in a bloodless coup aided by the British in 1966—just as oil and its transformative wealth started flowing into Abu Dhabi. Where his elder sibling resisted spending Abu Dhabi’s new fortune, Zayed embraced modernization, development, and a vision for uniting several tribes under a single state—setting the stage for the creation of the United Arab Emirates in 1971.

When the UAE was formed, Tahnoun was almost 3 years old. A middle child among Zayed’s 20-odd sons, Tahnoun is one of the so-called Bani Fatima—the six male children of Zayed’s most favored wife, Fatima, and his most important heirs. Zayed groomed these sons to go abroad, become worldly, and take up the mantle of the UAE’s future. But even as he established a state that carefully distributed new oil wealth among Abu Dhabi’s Bedouins, Zayed steered his heirs away from business and self-enrichment. Perhaps mindful of the assassinations and coups that preceded him, Zayed wanted to ward off the perception that the al Nahyans were benefiting unfairly from their role as custodians of the country.

In the mid-1990s, Tahnoun found himself in Southern California. One day in 1995 he walked into a Brazilian jiujitsu dojo in San Diego, asking to be trained. He introduced himself as “Ben” and, according to an article on Brazilian Jiu-Jitsu Eastern Europe’s website, went out of his way to show humility, arriving early and helping to clean up. Only later did he reveal he was a prince of Abu Dhabi.

As Zayed’s health failed in the late 1990s, his sons began to step into bigger roles—and to break away from his guidance by starting businesses of their own. It was around this time that Tahnoun started his first holding company, the Royal Group, the entity he would use to incubate the Hydra chess computer. He also started a robotics company that produced a humanoid robot, REEM-C, which in turn was named after an island in Abu Dhabi where he made a series of real estate investments.

When Zayed died in 2004, Tahnoun’s eldest brother, Kha-lifa, became the new ruler of Abu Dhabi and president of the UAE, and Mohamed, the eldest of the Bani Fatima, became the crown prince. The other sons took on an array of official titles, but their roles were more ambiguous.

As a reporter based in Abu Dhabi from 2008 to 2011, I fell into the pastime of “sheikh watching,” a Gulf-royal version of Kremlinology that involves reading between the lines of announcements and moves, and keeping in touch with palace insiders who occasionally betray a few secrets. At the time, Tahnoun seemed like a fascinating dilettante very far from actual power—he held no serious role in the government and seemed preoccupied with growing his fortune, dabbling in technology, and changing the skyline of Abu Dhabi.

That all changed when Tahnoun stepped up as the family member with the greatest knack for wielding a growing tool for nation-states: cyberespionage.

In July 2009, thousands of BlackBerry users across the UAE noticed their phones growing dangerously hot. The culprit was a supposed “performance update” pushed by Etisalat, the UAE’s largest telecom provider. In reality, it was spyware—an early experiment in mass surveillance that backfired spectacularly when BlackBerry’s parent company exposed the scheme.

I experienced this myself one day on a trip from Abu Dhabi to Dubai, bringing my BlackBerry to my ear and finding it so hot it nearly burned my face. It was my first direct, personal experience of the UAE’s hidden police state. But shades of its existence are apparent to anyone who has spent time in the Gulf States. Violent crime is nearly nonexistent, and life can be smooth, even luxurious. But in moments of stress or risk, these countries can become very dangerous places, especially for residents who dare hint at dissent.

The revolutions of the Arab Spring in 2011—which saw four Middle Eastern autocrats topple in the face of massive, Twitter-organized crowds—only heightened the UAE’s resolve to stamp out any green shoots of democracy. When a handful of Emirati activists made their own mild case for human rights and political reform in 2011, the state convicted them on charges of royal defamation. Then it promptly pardoned and released them into a life of surveillance and harassment.

While there’s no evidence that Tahnoun had any direct involvement in the BlackBerry debacle, he would soon come to oversee an empire capable of far more sophisticated spycraft. In 2013, he was named deputy national security adviser—around which time the UAE’s ambitions to spy on its residents and enemies started to reach an industrial scale.

For several years at that point, the UAE had been running a secret program known as Project Raven, formed in 2008 under a contract with consultant and former US counterterrorism czar Richard Clarke. The US National Security Agency had blessed the arrangement, meant to give the UAE state-of-the-art surveillance and data analysis capabilities to contribute to the war on terror. But around 2014, Project Raven took a new tack. Under the new management of a US contractor called CyberPoint, it recruited dozens of former US intelligence operatives with a simple pitch: tax-free salaries, housing stipends, and a chance to fight terrorism.

But fighting terrorism was, in fact, only part of the agenda. Within two years, the project’s management changed hands yet again to a company called Dark-Matter, effectively an Emirati state-owned firm. Emirati intelligence leaders placed Project Raven under their own roof—just two floors from the UAE’s own version of the NSA. The message to Project Raven’s employees: Join DarkMatter or leave.

For those who remained, the job included tracking journalists, dissidents, and other perceived enemies of the state and the royal family. Among the key American operatives who stayed on with DarkMatter was Marc Baier, a veteran of the NSA’s elite Tailored Access Operations unit. Emails later showed Baier chatting with the Italian surveillance firm Hacking Team, describing his UAE clients as “the most senior” and demanding white-glove service as he shopped for hacking tools. Other former NSA hackers on the Project Raven team got busy developing custom attacks for specific devices and accounts.

They got to human rights activist Ahmed Mansoor—one of the Emiratis who had blogged in favor of democratic reform during the Arab Spring—through his child’s baby monitor. It was 2016, and Mansoor had grown used to his devices behaving strangely: phones that grew mysteriously hot, suspicious text messages, drained bank accounts, according to a person familiar with his experiences. His phone had even once been infected with Pegasus spyware, a notorious product made by the Israeli cyber-arms firm NSO Group. But the baby monitor was new. Unknown to him, operatives at DarkMatter were using it to listen to his family’s private conversations.

In another project, DarkMatter assembled what it called a “tiger team”—a task force to install mass-surveillance hardware in public places. These probes would be capable of “intercepting, modifying, and diverting” nearby traffic on UAE’s cellular networks, according to an Italian security researcher who was being courted by DarkMatter in 2016. “To operate as we want them to, these probes are going to be put everywhere,” the prospective hire, Simone Margaritelli, was told in an email during his recruitment process.

And who was ultimately overseeing all this activity? In early 2016, Tahnoun had been named national security adviser, which placed him fully in charge of UAE intelligence. And there are signs that the ultimate controlling party over DarkMatter was none other than Tahnoun’s investment firm, the Royal Group.

Eventually, I may have become a target of the UAE’s hacking apparatus myself. In 2021 a coalition of journalists called the Pegasus Project informed me that my phone had been targeted by the UAE using Pegasus spyware in 2018. At the time I’d been reporting on a global financial scandal that implicated a member of the Abu Dhabi royal family—Sheikh Tahnoun’s brother, Mansour. The UAE denied that it had targeted many of the people identified, including me.

The hacking and tracking of American citizens would eventually become a red line for some of Project Raven’s former intelligence agents. “I am working for a foreign intelligence agency who is targeting US persons,” a Project Raven whistleblower named Lori Stroud would tell Reuters in 2019. “I am officially the bad kind of spy.”

The ensuing scandal resulted in US federal charges for several of its ex-NSA leaders, including Baier. DarkMatter and Project Raven, meanwhile, were painstakingly broken down, scattered, rebranded, and then subsumed into other companies and government departments. Many of their pieces and personnel eventually moved under the umbrella of a single new entity founded in 2018—called G42.

G42 has denied publicly it had any connections to Dark-Matter, but the threads aren’t hard to see. One DarkMatter subsidiary, for instance, was an entity that worked especially closely with Chinese companies. Not only did it eventually appear to become part of G42, but the subsidiary’s CEO, Peng Xiao, went on to become the CEO of G42 itself.

A Chinese speaker who studied computer science at Hawaii Pacific University, Xiao’s past is otherwise a black box. Though he was a US citizen for a time, he eventually surrendered his US passport for UAE citizenship—an exceedingly rare honor for a non-Emirati. And under a subsidiary of G42 called Pax AI, Xiao helped produce the next evolutionary step in DarkMatter’s legacy.

One morning in 2019, millions of phones across the UAE lit up with a cheery notification. A new messaging app called ToTok promised what WhatsApp couldn’t—unrestricted calling in a country where the voice-calling function of most chat apps was blocked. Within weeks, it had shot to the top of Apple’s and Google’s app store even beyond the Emirates. But there was a catch. Each time someone tapped the app icon, the user gave the app access to everything on that phone—photos, messages, the camera, voice calls, location.

Data from millions of phones flowed to Pax AI. Like DarkMatter before it, Pax AI operated from the same building as the UAE’s intelligence agency. The ToTok app itself came from a collaboration with Chinese engineers. For a regime that had spent fortunes on NSO Group’s Pegasus spyware and DarkMatter’s hacking teams, ToTok was elegantly simple. People didn’t have to be laboriously targeted with spyware—they were eagerly downloading it.

Representatives of ToTok adamantly denied that their product was spyware, but an engineer who worked at G42 at the time told me that all of the voice, video, and text chats were analyzed by AI for what the government considered suspicious activity. (Among the easiest ways to get flagged: placing calls to Qatar, then a rival in a mutual cyberwar, from within the UAE.) G42 declined to comment on specific details for this story but responded to WIRED with an overall statement: “G42 is steadfast in its commitment to responsible innovation, ethical governance, and delivering transformative AI solutions globally.”

Inside G42, staff sometimes refer to Tahnoun as “Tiger,” and his orders can swiftly change the company’s course. One mandate from Tiger, according to a former engineer, was to build him either a business that generates $100 million in revenue a year or a technology that makes him famous. In the workplace, there is no mistaking that the conglomerate has one foot inside the security state: Most of the company’s technology and data centers are based in Zayed Military City, a restricted-access zone, and all G42 staff need to pass security clearances to get hired.

Through G42, government intelligence services, and other cybersecurity entities, Tahnoun had effectively come to oversee the UAE’s entire hacking apparatus. But at a certain point, control over the UAE’s spy sector and the industry around it wasn’t enough for Tahnoun.

By the turn of the decade, Tahnoun had ambitions for more political power over the whole of the Emirates. His sibling Mohamed had been serving as the de facto leader of the country since their brother President Kha-lifa suffered a major stroke in 2014. Now, as Khalifa’s health continued to fail and Mohamed’s formal accession to the throne was becoming imminent, the position of the next crown prince was up for grabs.

These moments of dynastic uncertainty can be dangerous. In Saudi Arabia, the sons of the country’s first king, Abdulaziz al-Saud, have taken the throne one after the other ever since the 1950s. By the time the current king, Salman, took power in 2015, he was 80 years old, and the ranks of potential heirs below him had become crowded, corrupt, and rife with internal tensions. That’s why, in 2017, King Salman’s son Mohammed, or MBS, struck out to eliminate his rivals—mostly cousins and their aides—by arresting them in a purge, asserting himself as the new strongman.

In Abu Dhabi, Tahnoun’s argument in the succession debate, according to royal insiders, was that his brother Mohamed should follow precedent and allow the sons of Zayed to rule while they were of good health and sound mind—a system that would place him in contention. But Mohamed was adamant that his own son Khalid should be crown prince, a signal to the country’s large youth population that they were represented high up in government.

Tahnoun argued his point for more than a year, even providing evidence that Mohamed’s plan contradicted their father’s request for succession. But in the end, the brothers worked out a deal. Tahnoun agreed to set aside his ambition to be the crown prince or ruler—in exchange for vast power over the country’s financial resources. It was this bargain that would ultimately put him in charge of $1.5 trillion in sovereign wealth.

In 2023, Tahnoun was made chairman of Abu Dhabi Investment Authority, the largest and most important sovereign wealth fund in the country. Khalid’s appointment as crown prince was announced weeks later.

Officially, Tahnoun got a modest bump in title to become deputy ruler along with his brother Hazza. But those dealing with Abu Dhabi over the past few years say the same thing: Tahnoun’s powers have increased by an extraordinary degree, and not just in finance. He has also taken over diplomacy with Iran, Qatar, and Israel, and even handled the United States for a time when relations with the Biden administration declined. “Whenever there’s a difficult file, it’s given to Tahnoun,” says Kristian Coates Ulrichsen, a scholar of Gulf politics at the Baker Institute for Public Policy at Rice University. That skill has helped him “grow his power enormously,” Ulrichsen says.

As Tahnoun has gained access to new resources, he has plowed them into his maze of investments and conglomerates. Under the Royal Group, he controls not only G42 but also another conglomerate called the International Holding Company—itself a massive consortium that employs more than 50,000 people and owns everything from a Zambian copper mine to the St. Regis golf club and island resort in Abu Dhabi. He also oversees First Abu Dhabi Bank, which is the UAE’s largest lender, and another multibillion-dollar sovereign wealth fund called ADQ.

And now, with a growing position in the global AI arms race, Tahnoun’s empire also includes a stake in the future of humanity.

In December, the US government confirmed it had authorized the export of some Nvidia GPUs to the UAE—specifically to a Microsoft-operated facility inside the country. At G42, subsidiaries have kept multi-plying: Space42 focuses on using AI to analyze satellite imaging data; Core42 aims to build massive AI data centers across Abu Dhabi’s deserts.

Inside the US security establishment, many remain worried about the US tech sector’s increasingly close relationship with the UAE. One unsettling fact, according to a former security official, was that China made no protest over Tahnoun’s decision to tear out all of Huawei’s equipment and sever ties with the company in 2023. “They didn’t raise a peep,” the official told me. When Sweden banned Chinese companies Huawei and ZTE from its 5G rollout in 2020, Beijing’s foreign ministry spoke out against it, and Swedish telecom giant Ericsson lost huge amounts of business in China in retaliation. By contrast, G42’s big breakup with China somehow got a pass—suggesting to the official that there may be some kind of backdoor understanding between the two nations.

In a statement to WIRED, US congressman Michael McCaul reiterated his concern that technology could leak to China through the UAE’s deal with Microsoft, and stressed the need for tighter guardrails. “Before advancing this partnership and others like it further, the US must first establish robust, legally binding protections that apply broadly to AI cooperation with the UAE,” he said.

But even if those guardrails were put into place, the UAE has a history of finding ways to do what it wants. I’m reminded of the briefings that executives from Israel’s NSO Group gave to journalists for a time in the early 2010s, assuring them that Pegasus spyware had safeguards against abuse—and that Pegasus clients (like the UAE) would be blocked from targeting US and UK phone numbers (like mine). And I’m reminded of the blessings that the NSA gave to Project Raven at its inception.

While Donald Trump and his new administration are expected to continue with export controls over GPU chips, the view from people inside Tahnoun’s orbit is that the new administration will likely be much more “flexible” about the UAE’s AI ambitions. Plus at least one Trumpworld insider has a vested interest in the relationship: The UAE, Qatar, and Saudi Arabia have together contributed more than $2 billion to Jared Kushner’s private equity fund, guaranteeing the fund some $20 million to $30 million in annual management fees alone. Abu Dhabi’s leaders have consulted with Kushner and other Trump insiders, including former secretary of state Mike Pompeo, on AI policy, according to people familiar with the discussions.

While the continued supply of GPUs could be a remaining source of leverage for the US, it could be a declining one as rival chips improve. Some analysts argue that, even now, export controls are not the source of strength that American officials think they are. “AI is not like nuclear power where you can restrict the materials,” says computer security expert Bruce Schneier. AI technology is already highly distributed, he says, and the idea that American companies are at a huge and absolute advantage is a mirage.

Now that Tahnoun has been “brought inside the tent”—and given a key and expanding role as an investor of choice for the current winners in the AI race—he has certainly succeeded in gaining some leverage of his own. And those who keep needing money from the UAE may be happy to see it gain more clout. At a World Government Summit last year, Sam Altman suggested that the UAE could even serve as the world’s “regulatory sandbox” for AI—a place where new rules for governing the technology can get written, tested, and advanced.

Meanwhile, the Middle East could be entering a period, like the aftermath of the Arab Spring, when rules are largely off the table. Now that rebels have taken over Syria from the regime of Bashar al Assad, the Gulf States—especially the UAE—will be anxious to increase surveillance to avoid any spread of Islamist unrest. “We’re going to see more repression, more use of surveillance technologies,” says Karen Young, a senior fellow at the Middle East Institute in Washington. And when it comes to managing threats and winning games of strategy, Tahnoun likes to make sure he’s playing with the most fearsome machine in the world.

Source : Wired